The Refinitiv ratings

NBB ranks 1st in the Arab World banking sector in ESG

MANAMA, April 27, 2022

The National Bank of Bahrain (NBB) has ranked first in the Arab World’s banking sector as per Refinitiv Environmental, Social and Governance (ESG) Scores as of April 26, 2022.

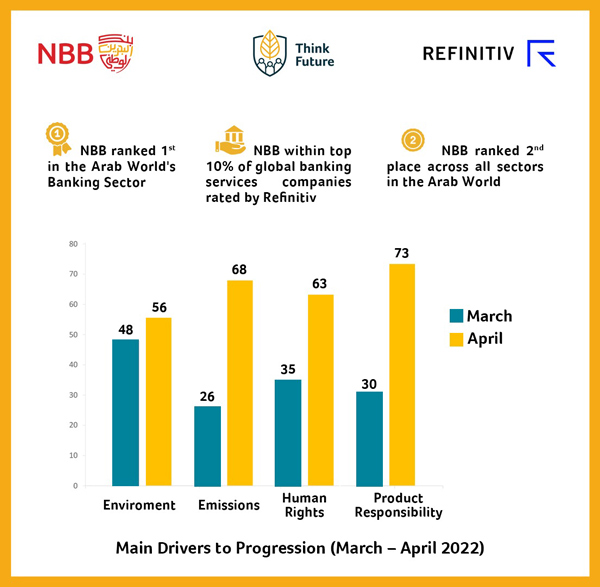

The recognition reflects the bank’s conviction to become a leader in sustainable banking within the Arab World. NBB’s achieved score of 72 points also places it within the top 10% of global banking services companies rated by Refinitiv, earning a 2nd place ranking across all sectors in the Arab World.

This milestone underscores the bank’s continuous efforts to implement ESG considerations across its business and operational conduct, following a commitment to become a more responsible organisation dedicated to meeting the needs of its various stakeholders.

The ranking aligns with NBB’s promise to support local and global initiatives through the kingdom’s Economic Vision 2030 and the United Nations’ Sustainable Development Goals.

Improving scores

Showcasing a steady progression since October 2021, NBB has substantially improved its emissions, product responsibility and human rights scores. Today, NBB’s improved score places it above renowned banks in the region within the Refinitiv database.

Commenting on the recognition, Jean-Christophe Durand, CEO of NBB, said: “We are proud to lead the Arab World with our recent Refinitiv ESG scores. NBB showcases a resilient effort towards embedding ESG considerations across our business practices and operational conduct. Our positioning highlights our positive contributions towards our community as well as our commitment to responsible banking. Sustainability plays an essential role in our organisation, and will continue to be a priority at NBB.”

Dana Buheji, Group Chief Human Resources and Sustainability Officer at NBB, said: “NBB’s commitment to ESG has enabled us to achieve our current score and rank us as the top ESG-aligned financial institution in the region. Our sustainability roadmap has allowed us to progressively integrate ESG practices into the core of our business, showcasing our overall growth as a bank. Sustainability is an evolving journey, one that focuses on maintaining mutually beneficial agreements with added-value to our key stakeholders while also enabling us to elevate our performance, reputation and positioning within the industry. We are committed to catering to the future needs of our stakeholders with inclusivity for all.”

Sustainability-driven products

The bank’s recent sustainability-driven products and services include NBB’s offer of exclusive financing on solar panel installation and education. ESG integration remains a core factor in the bank’s business strategy, as NBB became the first bank in the kingdom to successfully attain the ISO 14001:2015 Environmental Management Systems (EMS) certification.

NBB has accomplished several key milestones on its journey towards embedding ESG across its operations. In 2021, NBB was the only constituent representing Bahrain on the Refinitiv Arab Federation of Exchanges (AFE) Low Carbon Select Index.

The bank was additionally awarded “The Middle East’s Best bank for Corporate Responsibility” by the Euromoney Awards for Excellence 2021 as well as Global Finance’s ‘Outstanding Leadership in Sustainability Transparency’ Award, recognising the Bank as future industry leaders.

Refinitiv is a provider of transparent data surrounding ESG practices within the financial industry. Its scoring system objectively measures a company’s ESG performance, commitment and effectiveness, based on company-reported data. More than 9,500 companies globally are scored and ranked as per Refinitiv’s ESG pillars.-- TradeArabia News Service