Chemicals industry grapples with inflation, subdued growth, says report

DUBAI, December 7, 2022

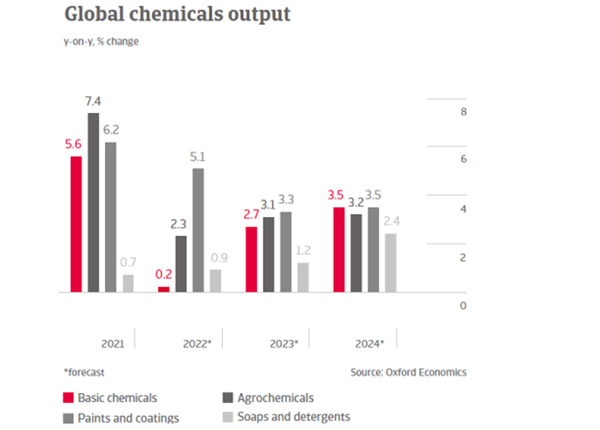

Growth predictions for the global chemicals industry are subdued as businesses in many advanced economies face an economic downturn, reveals a report by trade credit insurer Atradius.

Persistent inflation and aggressive interest rate rises are leading to a deterioration in demand, in particular from consumers, and from businesses in the automotive and construction industries, the report points out.

According to Atradius, although chemicals businesses in China are not facing the same levels of gas shortages that can be seen in Europe, many producers have had to deal with production pauses and supply chain interruptions due to ongoing local Covid-19 lockdowns. The US chemicals sector currently outperforms most other regions, benefitting from access to cheap shale gas, although a difficult domestic market means growth forecasts are modest, the report reveals.

Short-term challenges

Shortage of gas/gas rationing: The chemical industry is very energy intensive and requires high levels of natural gas as feedstock. There is looming uncertainty about the war in Ukraine and its destabilising effect on energy supply, for Europe in particular. Major gas shortage or gas rationing measures would severely affect European chemical producers, Atradius notes.

Economic downturn in advanced economies: Persistent and broadening inflation pressures, and aggressive tightening from central banks in response, are increasingly weighing on the outlook for advanced economies. A persistent recession and ongoing high inflation could lead to sharply deteriorating chemicals demand from both consumers and key buyer industries such as automotive and construction, it reports.

Mid-and long-term outlook: opportunities and challenges

Regional cost competiveness: The US shale gas boom has restructured the landscape of the global chemical industry, particularly for basic chemicals. The US chemical industry has a feedstock cost advantage due to low and more stable gas prices, attracting larger investments. Other regions, in particular Europe, are facing a long-term competitive disadvantage, says the report.

Rising middle class in emerging markets: Rapid urbanization and increasing household purchasing power of the middle class in emerging markets should boost demand for soaps and detergents products.

Energy transition and sustainability concerns: This will create challenges and opportunities for chemical business as companies face tighter regulatory directives and changing customer preferences. There is growing demand for ‘green’ and ethical products. This includes consumers asking where ingredients come from and assessing environmental impacts. Companies are facing major investments in decarbonisation and optimisation of their carbon footprint. Pressure from various stakeholder groups is increasing, and ESG performance is expected to be benchmarked as highly as cost and other productivity metrics, the report concudes.--TradeArabia News Service