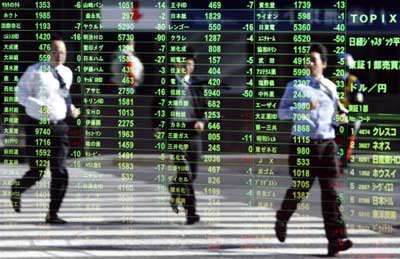

Pedestrians are reflected on a stock quotation board at a brokerage in Tokyo.

World shares soar to six-year high, Euro firm

London, November 29, 2013

World stocks hovered around a six-year high on Friday as the faith in an improving global economy and support from central banks drove markets towards a third straight month of gains.

The Nikkei in Tokyo notched up its best November since 2005 despite some late profit taking in Asia, as the yen, at a five-year against the euro and a six-month low versus the dollar, boosted hopes for its big exporting firms.

European shares opened fractionally higher near a 5-1/2 year high, heading for a seventh week in positive territory out of the last eight.

London's FTSE, Paris's CAC 40 and Frankfurt's Dax all inched up, while Madrid's IBEX outperformed with a rise of 0.5 percent after ratings agency Standard and Poor's upped its outlook on Spain.

The rating firm also nudged up troubled Cyprus's outlook to stable but at the same time stripped the Netherlands of its AAA grade. The reaction in the bond market was largely muted.

After some higher-than-expected German and Spanish inflation numbers the previous day, economists were largely focused on the wider euro zone reading at 1000 GMT.

Markets were caught out last month after a plunge to just 0.7 percent prompted the ECB to cut the bloc's interest rates but a German figure of 1.6 percent suggests there may be less drive for more action from Frankfurt in Friday's number.

"I think the market is braced for a higher figure, and that will help ease concerns that the ECB will have to act again imminently," said Bank of Tokyo Mitsubishi FX strategist Derek Halpenny.

In the currency market, the euro was steady at $1.36 ahead of the data, and holding at 139.15 yen having set a new five-year high of 139.705 yen overnight.

Investors have been using the yen as a funding currency for carry trades with the Bank of Japan committed to keeping ultra-loose monetary policy to shore up growth -- in contrast to the U.S. Federal Reserve which is moving towards unwinding its $85 billion-a-month bond-buying campaign.

The yen is down almost 18 percent versus the euro this year, while it is off 15 percent against the greenback -- and is also set for its biggest one-month fall since January. The Nikkei has rallied 50 percent this year.

Data on Friday showed Japanese consumer inflation accelerated to a five-year high and factory output rose for a second straight month in October, more evidence the recovery in the world's third-largest economy should extend into 2014.

"Industrial production was good but it was below consensus. Gradually, the market is coming to believe the BOJ will be forced to react again sometime next year," said Kyoya Okazawa, head of global equities and commodity derivatives at BNP Paribas in Tokyo.

Among commodities, gold drifted around $1,247 an ounce but was on track for its biggest monthly drop since June, weighed down by the prospect of an eventual scaling back of U.S. central bank stimulus.

Gold has shed 6 percent in November and more than a quarter of its value this year in what will be its first annual loss in 13 years.

Growth-attuned copper rose to $7,055 a tonne but it too has lost 3 percent this month. In contrast, oil which was at just under $111 in London, is on course for its biggest monthly rise since August.

Unrest in Libya has kept supply worries at the front of traders' minds and offset hopes that last weekend's deal between world powers and Iran could lead to a boost for production.-Reuters