Qatar dodges shareholder duty on Glenstrata

Dubai, November 19, 2012

Una Galani

(The author is a Reuters Breakingviews columnist. The opinions expressed are her own.)

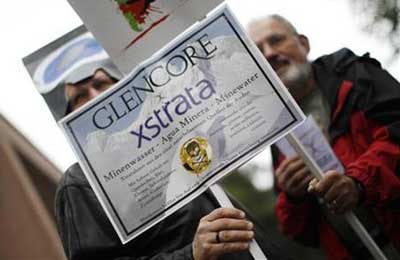

Qatar is dodging its shareholder duty. The emirate successfully used its muscle to extract better terms from Glencore in the commodity trader's union with miner Xstrata.

But the decision to vote in favor of the merger while abstaining on a side vote on retention bonuses makes Qatar Holding seem inconsistent at best.

The Qataris own 12 percent of Xstrata. Their refusal to back golden handcuffs for Xstrata staff is a snub to the scale of the $220 million incentive plan, according to a person familiar with the situation.

It isn't a show of solidarity with big institutional shareholders that oppose retentions in principle. In announcing its voting intentions, Qatar explicitly recognised that "retaining Xstrata's operational management is of critical importance to the successful and stable integration".

In other words, Qatar clearly supports, and even expects, the new board of the enlarged miner to devise an alternative pay scheme or ad-hoc packages for key staff in due course. The Gulf state and Glencore boss, Ivan Glasenberg, together have over $10 billion invested in the success of the $80 billion merger. Neither can afford for top talent to disappear.

But as it stands, the package isn't acceptable to Qatar. Logically, it therefore ought to vote no. Its decision to abstain is a cop out from good governance. Why the loss of conviction?

The Gulf state wants to avoid a sensitive debate that would put it against large institutional funds. The desire to bury its head in the sand will be reinforced by ongoing regulatory probes in the UK and US into fees paid to Qatar in relation to a capital fundraising by British bank Barclays in 2008 and fresh allegations of corruption over its winning bid to host the football 2022 World Cup.

Large shareholders ought to be able to negotiate effectively behind the scenes to keep an issue like this a sideshow. It is odd that the Xstrata board wasn't able to devise a retention plan that its lead shareholder could support. True, it may be harder for a sovereign investor to engage due to organisational peculiarities.

But Qatar was very public in its intervention forcing Glencore to offer more for Xstrata: it has chosen not to be a passive investor. If it doesn't want to be dismissed as an unreliable one, it needs to finish what it starts. – Reuters