The US is on track to export a record amount of fuel ethanol for the second year in a row in 2025, driven by growing international demand.

This growing market for exports is supporting

increased US fuel ethanol production, even as domestic consumption stagnates,

according to US Energy Information Administration (EIA)

report.

Fuel ethanol is a

renewable fuel that is commonly blended with gasoline and is made by fermenting

sugar from biomass, typically corn in the US.

The US is the largest

global producer and exporter of fuel ethanol.

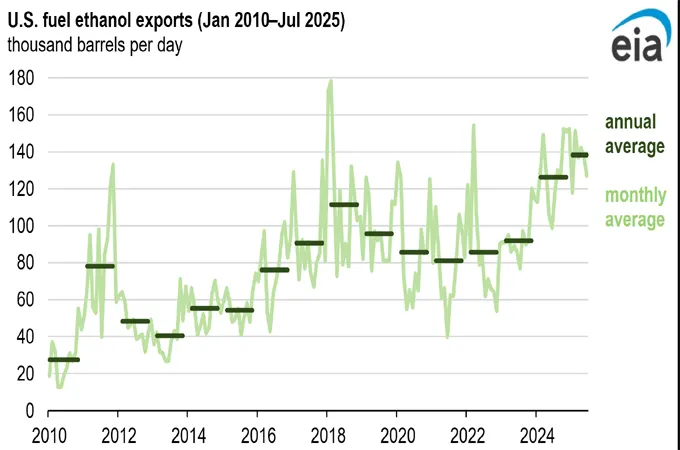

US fuel ethanol

exports are on track to set new records

In the first seven months of 2025, US fuel ethanol exports averaged 138,000

barrels per day (b/d)—the highest January through July average in EIA data, which goes back to 2010, and 9 per cent

more than 2024’s annual record of fuel ethanol exports.

Growing international

demand and a slight increase in production capacity are driving the

high fuel ethanol exports this year.

With growing exports

and flat consumption, exports are making up an increasing share of US fuel

ethanol production.

Through the first

seven months of 2025, 13 per cent of domestic ethanol production was exported,

compared with a record 12 per cent in 2024 and a pre-pandemic high of 11 per

cent in 2018.

Most of the

increase in fuel ethanol exports has gone to the Netherlands

Increased fuel ethanol

exports to the Netherlands accounted for most of the growth from 2024 through

July 2025, likely reflecting growing demand in Europe.

Some of Europe’s

busiest trade ports are in the Netherlands.

Vortexa tanker

tracking data indicate that as the Netherlands has increased fuel ethanol

imports from the US, it has also increased exports to the United Kingdom,

France, and Ireland.

In addition, India,

the United Kingdom, and Canada, all of which have blend mandates, continue to

import substantial volumes of fuel ethanol, with Canada remaining the top

destination.

Rising ethanol exports are driving domestic production growth

The expansion of the fuel ethanol export market has led to a proportional

increase in US fuel ethanol production.

This growth has pushed

domestic production beyond the pre-pandemic peak in 2018, despite lower

domestic consumption.

US fuel ethanol

consumption remains below pre-pandemic levels because of lower gasoline

consumption.

Fuel ethanol

consumption tracks closely with motor gasoline consumption because nearly all

motor gasoline sold in the US is about 10 per cent ethanol by volume (E10) and

virtually all fuel ethanol is used for blending with gasoline.

In EIA latest Short-Term Energy Outlook, EIA forecast ethanol net exports and production to remain near record highs in 2026 due to expected record corn production, in addition to the same factors driving production and exports this year. -

EIA forecast consumption to remain below pre-pandemic levels as motor gasoline consumption remains flat.OGN/TradeArabia News Service