Emirates NBD net profit up 34% in 2021 to $2.53bn

DUBAI, January 26, 2022

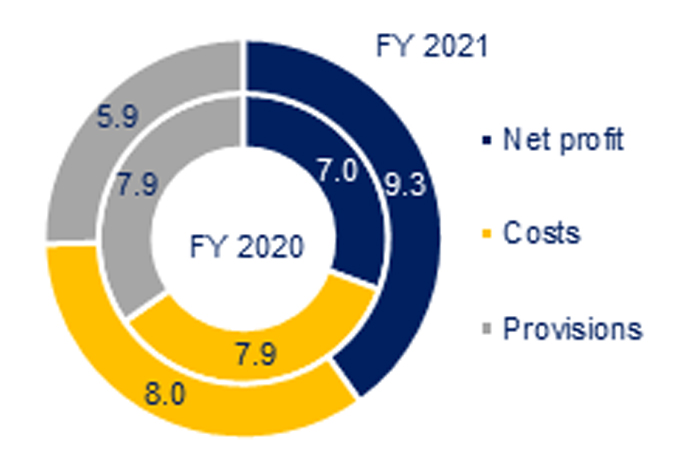

Dubai-based Emirates NBD’s net profit jumped 34% to AED9.3 billion ($2.53 billion) in 2021, demonstrating the resilience of the group’s diversified business model and the strong recovery as economic growth rebounded in 2021.

Despite interest rates remaining at historically low levels, the underlying business momentum continues to strengthen with record demand for retail financing, the bank said.

The group’s balance sheet strengthened with further improvements in deposit mix, core capital and liquidity while credit quality remained stable. Emirates NBD has used this strength to support customers during the pandemic and empower them during last year’s economic recovery, it said.

In light of the group’s strong performance, the Board of Directors are proposing a 25% increase in the cash dividend to 50 fils per share.

Key Highlights – FY 2021

* Strong operating performance as loan mix improved on strong demand for retail financing, an efficient funding base and a substantially lower cost of risk;

• Total income up 3% y-o-y as higher retail volumes offset impact of low interest rates. Total income up 32% y-o-y in Q4-21 on increased transaction activity and FX and Derivative income;

• Expenses increased 2% y-o-y as business recovered and investment continued in International, digital and Advanced Analytics with 33.5% cost-to-income ratio within management guidance;

• Impairment allowances down substantially 26% y-o-y, with 124 bps cost of risk within pre-pandemic range;

• Net profit jumped 34% y-o-y to AED9.3 billion;

• Proposed dividend substantially increased by 25% to 50 fils per share

• Total assets: down 2% at AED687 billion due to currency translation;

• Customer loans: AED422 billion with 2021 being a record year for retail financing;

• Deposit mix: highest ever CASA balances, increasing by AED38 billion in 2021, positioning the group very well for eventual rate rises;

• Credit quality: NPL ratio increased by 0.1% to 6.3% during 2021 with coverage ratio strengthening 10.2% to 127.5% reflecting the Group’s prudent approach to earlier credit provisioning

• Capital and Liquidity: 177.6% Liquidity Coverage Ratio and 15.1% Common Equity Tier-1 ratio reflect the Group’s core strengths to support customers and create opportunities to prosper

The strong balance sheet and resilient profitability enables the group to support customers and empower them to benefit from the strong economic recovery, the bank said.

The group is committed to supporting and adapting to customers’ changing needs by offering market-leading products and services, digital innovation and a superior customer experience while further expanding its international presence, it said.

Other highlights

• Customer support: AED10.7 billion of support provided to over 131,000 customers;

• Customer repayments: AED8.2 billion of deferral support demonstrate the group’s successful efforts in mitigating the financial impact on customers from Covid-19;

• Social responsibility: Emirates NBD Asset Management strengthened its commitment to responsible investment by becoming a signatory of the United Nations supported Principles for Responsible Investment

• ESG: Branches in UAE and KSA were the first in the region to secure LEED Gold-certification, highlighting the group’s commitment to ESG;

• Credit Rating: All ratings affirmed with Stable Outlook, by Fitch, Moody’s and Capital Intelligence

• Digital: Launched Advanced Analytics Centre of Excellence to identify untapped revenue streams by scutinising 21 million daily customer data points

• International expansion: Expanded branch network in KSA and Egypt in 2021 with approval granted to expand branch network in India.

Sheikh Ahmed Bin Saeed Al Maktoum, Chairman, Emirates NBD, said: “Emirates NBD’s profits grew 34% in 2021 demonstrating the resilience of the group’s diversified business model. Emirates NBD continued financing the real economy and was rewarded as economic growth rebounded, helped by government economic stimulus packages and the successful handling of the pandemic by the country’s wise and visionary leadership."

"As the Official Banking Partner of Expo 2020 Dubai, the group is honoured to showcase its pioneering vision for the future of global banking and spotlight the UAE’s investment potential," he said.

Hesham Abdulla Al Qassim, Vice Chairman and Managing Director, said: “Emirates NBD’s profits jumped 34% to AED9.3 billion in 2021 as the strong economic recovery drove record demand for retail financing. he diversified balance sheet and solid capital base remains a core strength of the group. We used this strength to support clients in 2021, empowering them to be part of the economic recovery.

"With 98% of transactions now through digital channels, we continue to be a leader in digital banking and innovation. We are honoured to help the UAE be ranked in the Top 10 of the IMD Digital Competitiveness Index for the first time ever in 2021," he said.

Shayne Nelson, Group Chief Executive Officer, said: “There are many positives in the group’s strong set of results. The rise in income despite low interest rates, coupled with an improvement in the cost of risk to pre-pandemic levels, helped deliver a AED9.3 billion profit."

"International operations contributed 38% of total income in 2021. The funding mix improved as we added a further AED 38 billion of Current Accounts and Saving Account balances during 2021 and we are well positioned to benefit from a potential rise in interest rates," he said. - TradeArabia News Service