Financial accounting and Blockchain

MANAMA, May 6, 2020

By Ghias ul Hassan Khan

Blockchain was established in 2009 initially to deal with cryptocurrency transactions. However, now it has more applications and has emerged as a solution for handling a huge amount of data and information systematically as the world moves towards the concept of Bigdata.

Blockchain is one of the products of the concept called distributed ledger technology (DTL) in accounting. It enhances the integrity of the files kept in it and during the transfer from one node (user) to another. It is useful in every field of work including financial markets, financial services, insurance, smart contract and voting processes, government work and many more.

Accounting is an art of classifying, recording, interpreting, analysing and summarising business transactions (give and take) in a systematic manner, which users can understand easily to make their decisions related to the performance and position of the company or business.

Blockchain – how it works in accounting

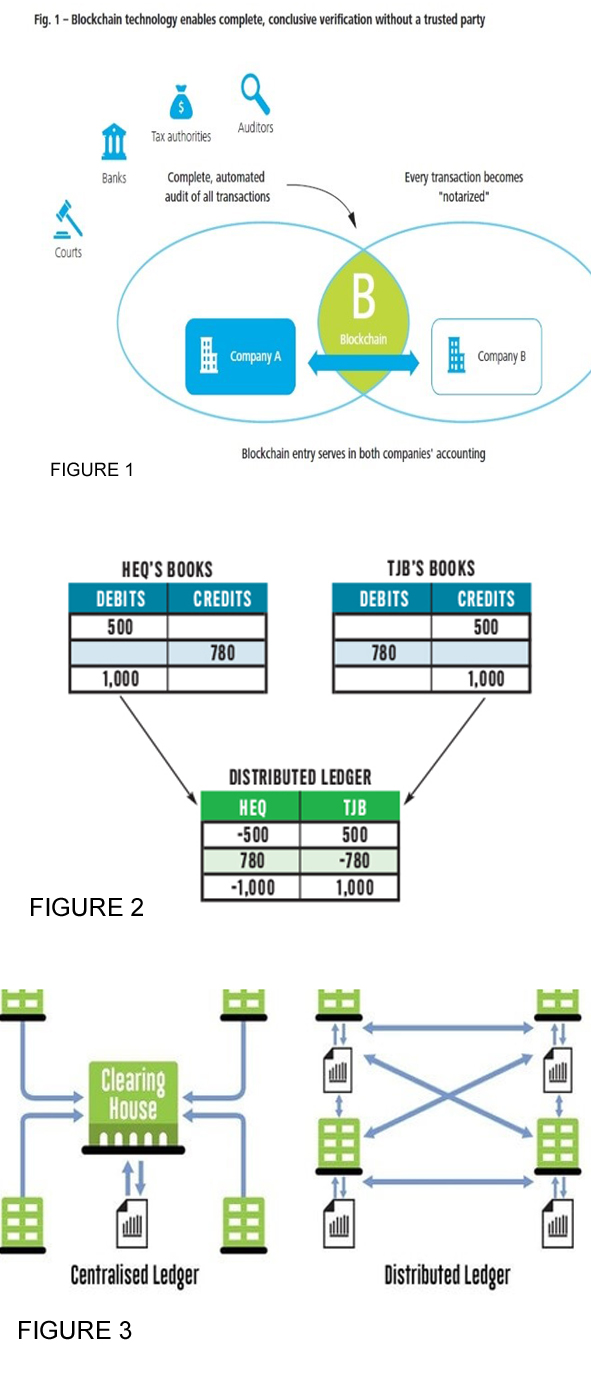

The working of Blockchain can be understood with the help of figure 1 (right). It arranges and records the financial accounting transactions in chronological order on a real-time processing basis and all the records in Blockchain are sealed cryptographically. The hash string used as a fingerprint of the data and information which makes it nearly impossible to alter and disrupt.

Accounting traditional systems

The traditional system of accounting refers to the recording of transactions based on accounting rules related to debit and credit in terms of increasing and decreasing patterns of different accounting heads. The record kept on two sides - the one is the buyer (receiver of goods or services) and the other seller (provider of goods or services) and they reconcile their extracted balances with each other when they need to do so. As every transaction has two aspects of give and take, it is also called a double-entry system, a method published by Luca Pacioli in 1494.

Emerging TRIPLE entry accounting system

Blockchain is like a great spreadsheet for registering all assets and other accounting system information for transacting then on a global scale.

In Figure 2 (right) distributed ledger shows the part of blockchain technology and financial details in three places, which reflects triple entry accounting as an emergent area of operations.

Blockchain technology Vs. conventional accounting system

We can compare the blockchain technology with the conventional accounting system in many ways. In a conventional accounting system, all the information and accounting records are kept in a centralised location, usually head office or information centre. Whenever the staff need the information, they must access that centralised data or location and update every time. In this case, not everyone has the authority to do so, perhaps only auditors or accountants up to a certain level can access these data. However, Blockchain provides an opportunity to store the information in a shared location called distributed ledger and the access is not confined only to selected personnel but to all concerned or associated parties as shown in Figure 3.

In this system each party has a unique public or private key to access the information and they use the same key for data authentication.

Merits of blockchain

1. It provides more clarity to accountants with the availability of data and resources becoming easier so they can spend their time more on planning and controlling, instead of traditional book-keeping. It also saves costs, which can be utilised in the enhancement of other activities.

2. As the records are cryptographically saved with identical hash string (which is also called file fingerprints), it makes it nearly impossible to alter any record at any point of time without proper authentication.

3. It also helps during audits in accessing huge data electronically, so saving time and money.

4. Initially, deployment of the system will may incur an investment cost, but in the long term it will result in cost reduction by means of saving in documentation, stationery, staff and other overheads cost

Risk areas of blockchain

1. Although it is highly secure and need verification at all nodes, since the files are placed electronically, they are vulnerable for unnoticed modifications.

2. It may face some resistance from companies as they do not want to share historic information on their financial matters.

Conclusion

Blockchain is a time and cost-saving platform and ultimately provide more flexibility in today’s changing working environment. With concerns about the potential risk being addressed, it is a tool that introduces a new dimension to accounting which reflects the distributed ledge concept to keep the infomania. The next step from here research can take to mitigate the risk areas as identified.

Reference

Figures:

1 - https://www.finyear.com/Blockchain-Technology-A-game-changer-in-accounting_a35816.html

2 - https://sfmagazine.com/post-entry/january-2019-from-the-mainframe-to-the-blockchain/

3 - https://www.invoiceberry.com/blog/blockchain-technology-evolving-conventional-accounting-systems/

* Ghias ul Hassan Khan is from the College of Business Administration, Department of Accounting,

University of Bahrain.