Blackberry agrees $4.7bn takeover deal

Toronto, September 24, 2013

Smartphone maker BlackBerry has agreed to go private in a $4.7 billion deal led by its biggest shareholder, allowing the on-the-go email pioneer to regroup away from public scrutiny after years of falling fortunes and slumping market share.

The $9 a share tentative offer, from a consortium led by property and casualty insurer Fairfax Financial Holdings, will set a floor for any counter offers that might emerge for Blackberry, which has been on the block since August.

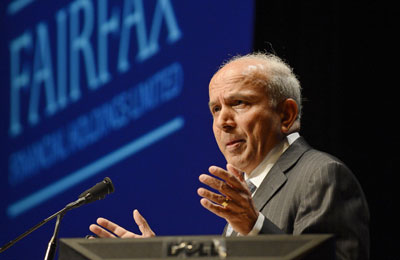

As an investor, Fairfax Chief Executive Prem Watsa is often described as the Canadian Warren Buffett because he also takes the long view.

Blackberry shares peaked above $148 in June 2008 when the company's devices were still the top choice for bankers, politicians and lawyers.

The stock, halted pending the announcement on Monday, closed below the offer price on Nasdaq, at $8.82, indicating the market's lack of faith that other bids would emerge.

"I would think a competing buyout offer is quite unlikely," said Elvis Picardo, strategist at Global Securities in Vancouver. "The miniscule premium, and the muted market reaction, is another indication that the market views the odds of a competing bid as slim."

BlackBerry, based in Waterloo, Ontario, once dominated the market for secure on-your-hip email. But it introduced consumer-friendly touchscreen smartphones only after it lost the lead to Apple Inc's iPhone and devices using Google Inc's Android operating system.

BlackBerry has until November 4 to seek superior offers, which the Fairfax group has the right to match. The group is seeking financing from Bank of America Merrill Lynch and BMO Capital Markets to complete the deal and has until that November 4 deadline to conduct its due diligence.

A BlackBerry statement did not name members of the consortium, although many in the financial community see Canada's deep-pocketed and influential pension funds as likely participants.

"We need to be careful given disclosure constraints, but we can say that we are focused on a strong Canadian solution," said Fairfax spokesman Paul Rivett.

CANADIAN BUFFETT

Watsa stepped down from the BlackBerry board of directors in August, citing a potential conflict of interest, as the company said it was exploring a sale.

Canada's Globe and Mail newspaper quoted Watsa as saying that a significant amount of the equity in the deal will come from within the country. The consortium included neither strategic players, nor other technology firms, he said.

BlackBerry's recent challenging years have been in stark contrast to the rapid growth it previously enjoyed.

The Z10 touchscreen device that the company hoped would claw back market share from the iPhone thudded badly at launch in January, and it has lost ground even in emerging markets where it had carved out an important role.

Donald Yacktman, president and founder of Yacktman Asset Management which holds something under 1 percent of BlackBerry according to Thomson Reuters data, said he does not expect a counteroffer to emerge.

"This is pretty much Plan B. They've clearly not hit the targets," he said.

Jack Gold, principal analyst and founder of J. Gold Associates, said "this is probably the best possible outcome of several unattractive options for BlackBerry." - Reuters